By Joshua HAWKINS

By Joshua HAWKINSSoft Commodity Trader & Economics Speaker

CERTIFIED ONLINE COURSES

The Soft Commodity Trading Life Cycle from A to Z

Discover the Trade Life Cycle and learn how Trading Firms operate

1. Intro: What is commodity trading?

2. Pre-trade: What needs to be done before signing a contract?

3. Trade is signed: Who steps in now?

4. Trade execution: Who executes the trade?

5. Trade settlement: What are the remaining steps?

COURSE OUTCOMES

Discover the key steps involved in a commodity trading firm’s operations.

SOFT COMMODITY LIFE CYCLE FROM A TO Z

Table of Contents

PART 1 (3h00)

What is commodity trading?

PART 2 (3h00)

Pre-trade and contract negotiation (including risks)

PART 3 (1h30)

Contract is signed, trade confirmation (PnL, credits, liquidity management, operations)

PART 4 (1h30)

Trade Execution (logistics, payment, etc.)

PART 5 (1h15)

Post Trade (accounting, tax, finance, etc.)

SPEAKER

Joshua Hawkins, Economics Speaker & Soft Commodity Trader

Trading is in Joshua Hawkins’s DNA, he comes from 5 generations of commodity traders. His family left England in the early 1800s and established Wise & Co a commodity trader in the Philippines where he grew up. He went on to attend Oxford University achieving a first class degree in Geography. From there he went on to join Louis Dreyfus Trading in London as a trainee graduating to trade Coffee, Sugar and Rice. He has also worked in shipping and oil with SwissMarine and Valhalla Marine respectively. He is now Soft commodity trader at Tereos (a large sugar industry player) Joshua Hawkins has another passion, education, being a qualified teacher he has also worked as a High School Geography and Economics teacher for extended periods. He is uniquely qualified to guide you through the world of commodity trading.

Trading is in Joshua Hawkins’s DNA, he comes from 5 generations of commodity traders. His family left England in the early 1800s and established Wise & Co a commodity trader in the Philippines where he grew up. He went on to attend Oxford University achieving a first class degree in Geography. From there he went on to join Louis Dreyfus Trading in London as a trainee graduating to trade Coffee, Sugar and Rice. He has also worked in shipping and oil with SwissMarine and Valhalla Marine respectively. He is now Soft commodity trader at Tereos (a large sugar industry player) Joshua Hawkins has another passion, education, being a qualified teacher he has also worked as a High School Geography and Economics teacher for extended periods. He is uniquely qualified to guide you through the world of commodity trading.Our Corporate Packaged Solutions

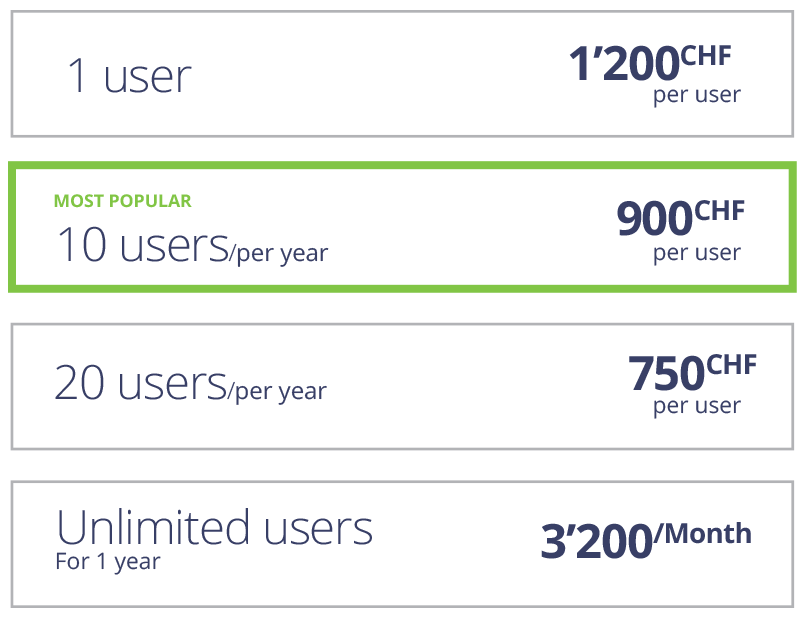

To find the perfect plan to train your team, contact our Training Manager

Certified Courses

At the end of the course, attendees who achieve a score of 75% or higher will receive an AW Academy certificate from Ampersand World. This internationally recognised certification is aimed at those wanting to enter the world of trading and professionals seeking to boost their knowledge in this field. Pre-requisites: None.

FINAL QUIZ

You will pass this test at the end of your curriculum. The latter will be composed of questions, and will group the different notions approached in the course of your experience.

TIME

This program consists of about 8 hours of training courses and complementary quizzes. This time is our recommendation to get successfully certified.

SPEAKER ACCESS

If you want to go further in your learning cycle, you can have access to our speaker and plan private lessons. Contact us for more details.

Welcome to the Academy

AW ACADEMY® is an e-learning platform focused on physical commodity trading, shipping, trade finance

and all related domains and animated by Ampersand World.

![]() LEARNING BY DOING

LEARNING BY DOING

Our online courses that teach general and/or specific commodity trading skills in a “learning by doing” format. We believe that learning about commodities is more efficient through simulations and practical case in which each attendant has opportunities to practice trading fundamental directly.

![]() UPGRADE YOUR TRADING SKILLS

UPGRADE YOUR TRADING SKILLS

Our online courses offers are targeted to people working in the world of trading or willing to learn more about this industry. This includes professional without trading experience, young graduate or HR specialists in the trading sector who would like to develop or up-date their trading skills.

![]() PROFESSIONALS SPEAKERS

PROFESSIONALS SPEAKERS

A unique feature of the AW ACADEMY® is that it is taught by a team of practicing speakers and other professionals who are selected not only for their professional reputation and accomplishment, but also to reflect the diversity of the trading profession.